A call for financial sector accountability in the energy transition

The urgent need to transition to sustainable energy sources has heightened the focus on renewable energy investments. However, this shift must be undertaken with a strong commitment to human rights and environmental protection. In a new policy paper, Swedwatch examines the critical role of institutional investors and the need for a more cohesive legislation to ensure a just and equitable transition.

As highlighted in a new policy paper, Investing Responsibly, by Swedwatch, renewable energy investments often overlook potential human rights and environmental harm along the value chain. For instance, hydropower dams built along international rivers can significantly alter river morphologies, leading to the deterioration of sensitive local ecosystems and biodiversity. This, in turn, affects millions of people who rely on fisheries and riverbank farming for their livelihoods and food security.

To mitigate such consequences, investors need to adopt a rights-based approach that prioritizes the long-term impacts and address issues such as displacement of communities, forced labor, and environmental degradation. It requires moving beyond third-party data by engaging directly with communities and stakeholders.

Large energy infrastructure projects, especially in low-income countries, carry complex and far-reaching risks that are often overlooked in ESG data but become evident through meaningful stakeholder engagement”, says Yayoi Lagerqvist, author of the paper at Swedwatch.

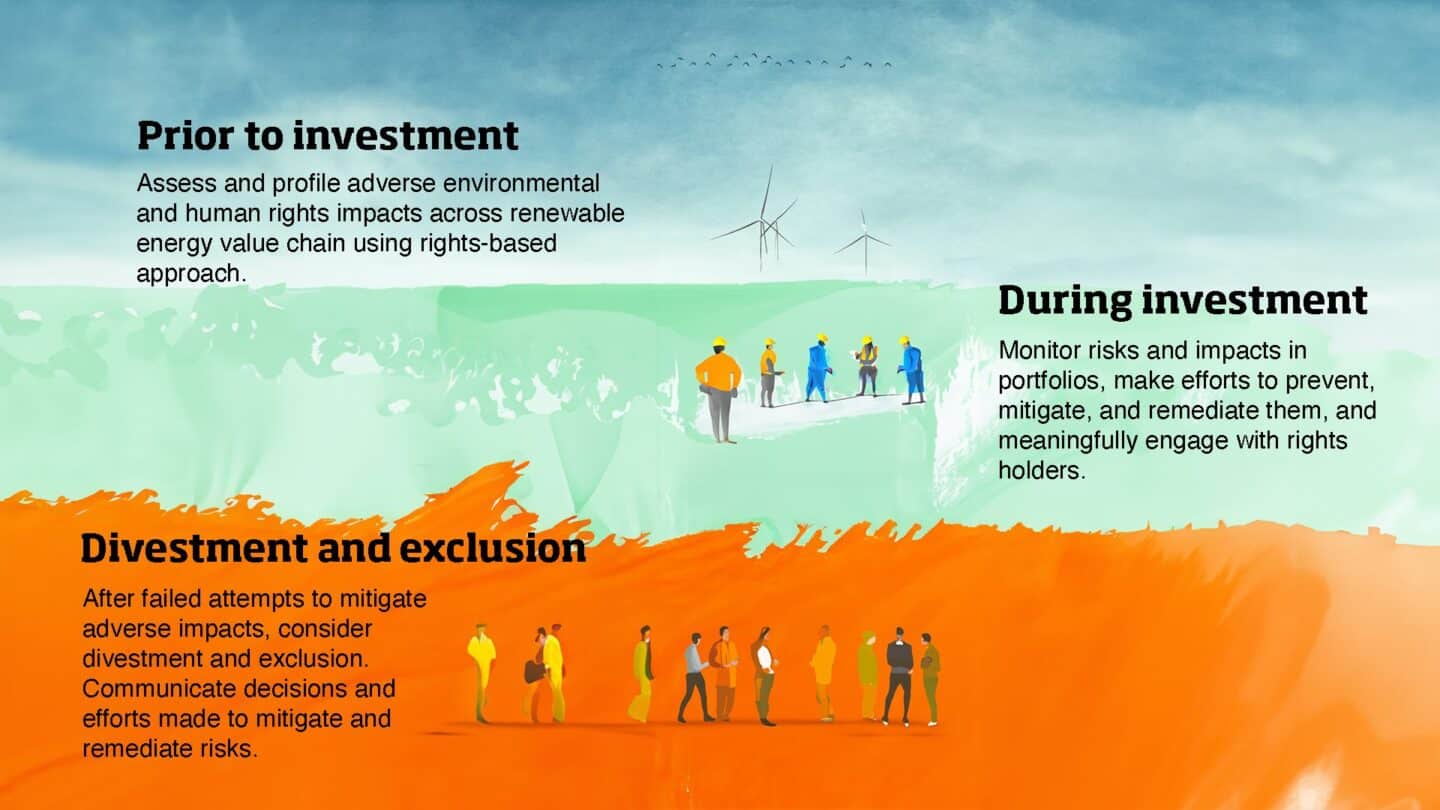

Moreover, investors must conduct thorough due diligence assessments – centered around rightsholder consultations – across the entire value chain, from extraction to disposal, to identify and mitigate risks at each stage. To appropriately understand human rights and environmental risks, it is crucial to allocate sufficient resources to integrate rightsholder consultation at every stage of the investment cycle.

Main steps for implementing a rights-based approach in the investment cycle

Current misalignments in the regulatory landscape

The paper also emphasises the need for governments, including EU Member States, to develop cohesive legislation aligned with international human rights standards. While ESG (Environmental, Social, and Governance) practices are evolving, stronger financial regulations are needed to prevent misleading claims about environmental sustainability by investors and companies.

While a fast energy transition is necessary, it is essential for regulators to develop coherent policies that protect and respect human rights across the renewable energy value chain, as well as policies to prevent investors and companies from falsely claiming positive impacts on environmental sustainability, says Yayoi Lagerqvist.

Download the policy paper:

What you will find inside the paper:

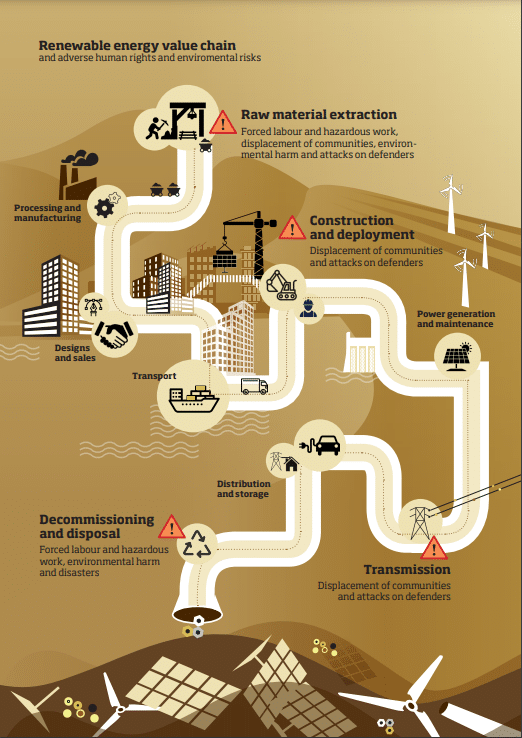

✔️An overview of salient human rights and environmental risks in the renewable energy value chain

✔️Guidance on six key steps for rights-based due diligence

✔️An analysis of critical gaps in EU’s regulatory frameworks and its nexus with investors and human rights

What is a rights-based approach to risks?

A rights-based approach centers on actively consulting rightsholders—those affected by business activities—to guide the due diligence process. Unlike a managerialist approach, which often frames human rights impacts as risks for businesses to control, a rights-based approach allows rightsholders to shape risk management. This ensures responses are tailored to their needs, fostering genuine accountability and positive human rights outcomes.

Large renewable energy projects often involve a variety of risks throughout the value chain. Key risks include forced labor during raw material extraction, community displacement and attacks on defenders during construction, and hazardous working conditions and pollution during decommissioning and disposal.