2017-12-12

Lack of green investments puts Paris Agreement at risk

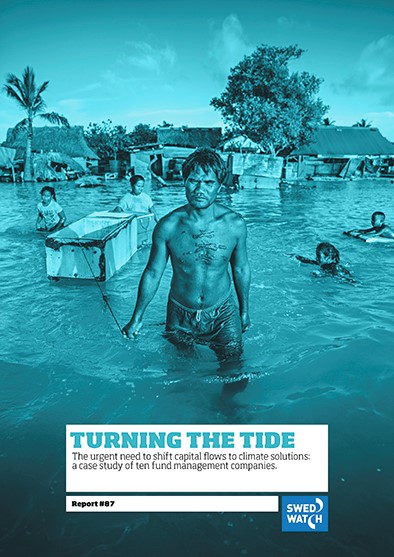

Two years after the Paris Agreement, there is little time left for the world to make a necessary climate transition. Although the finance sector has a crucial role to play, a new Swedwatch report shows that contributions made by Swedish investors to reach the goals of the Paris Agreement are not even close to being sufficient. Climate change is already impacting vulnerable groups in climate affected areas across the globe. To reverse the trend, investors across the globe need to act now.

Today, world leaders gather in Paris for president Macron’s One Planet Summit, which focuses on the important role of the finance sector in reallocating large capital streams towards green investments. Sweden is represented by Prime Minister Stefan Löfven and Minister for Climate Isabella Lövin.

On the day of the summit, a new Swedwatch report shows that Sweden’s ten largest fund management companies are not contributing to the fulfillment of goals of the Paris agreement.

The study, which compares the fund management companies’ current performance to results from a similar survey conducted by Swedwatch in 2015, shows that:

- The urgent need for concrete climate transition results, the ambitions and actions of the fund management companies are not sufficient.

- The investors included in the study have not set any targets for reallocation of capital from investments in fossil production to investments in green finance and climate solutions for mitigation and adaptation.

- Across the board, climate solutions are almost exclusively found in niche funds, which make up only a fraction of the total investments. Some investors deferred responsibility for choosing to invest in climate solutions to clients.

The fund management companies explain that one reason for not reallocating substantial capital is that climate risks are largely ignored in today’s short-term financial markets. Further, they refer to a current lack of green projects and climate solutions to invest in. They also describe that the fact that portfolio companies are not measuring and reporting their own climate impacts is a challenge for the sector.

However, in order to contribute effectively to the swift climate transition needed by 2020, as underlined in the Paris Agreement, it is not an option for investors to wait for improved company reporting and substantially increased client demand for green, climate-solution focused savings products.

The report recommends investors and large asset owners to develop and scale up new, climate-solution focused savings products, and publicly disclose both increases in green investments and negative climate impacts of their total investments. They should also maximise their leverage as shareholders to halt deforestation, fossil exploration and other projects, which increase the climate vulnerability of affected local communities.

Stricter requirements needed

The report concludes that the Swedish finance sector’s voluntary climate efforts have not supported the urgent climate transition needed; current portfolio investments in coal and renewable energy are in line with future temperature increases of 4-6 degrees.

Ahead of the One Planet Summit, Swedwatch, along with the Church of Sweden and the Swedish Society for Nature Conservation, has published an open letter to Stefan Löfven and Isabella Lövin. The letter encourages the Swedish government to introduce compulsory requirements on finance actors to conduct climate analyses for all of their investments and publicly disclose how they intend to contribute to the Paris Agreement.

FACTS ABOUT THE REPORT

Across the globe, finance actors are heavily invested in coal, fossil fuels and unsustainable agricultural practices that lead to deforestation. These investors contribute to emissions of greenhouse gases and undermine communities’ resilience to the effects of climate change. In the Paris Agreement, the world has committed to decrease emissions of greenhouse gases and contain global temperature increases below 2 degrees by the end of the century. However, strong and swift action before the year 2020 is crucial to stabilise the climate.

The report was developed in cooperation with the Church of Sweden and the Swedish Society for Nature Conservation and compares results with the 2015 Swedwatch report Is the Gold Turning to Sand? (in Swedish).

The fund managers included in the report are AMF, Danske Bank, Handelsbanken, Lannebo Fonder, Länsförsäkringar, Nordea, SEB, Skandia, SPP and Swedbank. Together, they manage assets worth 497 billion USD on behalf of retail and institutional clients.